Art Market in 2010: facts and figures. Part I

In 2010, the top segment of the art market finally managed to get out of the crisis. Good results have demonstrated, even the most speculative segment - Contemporary Art

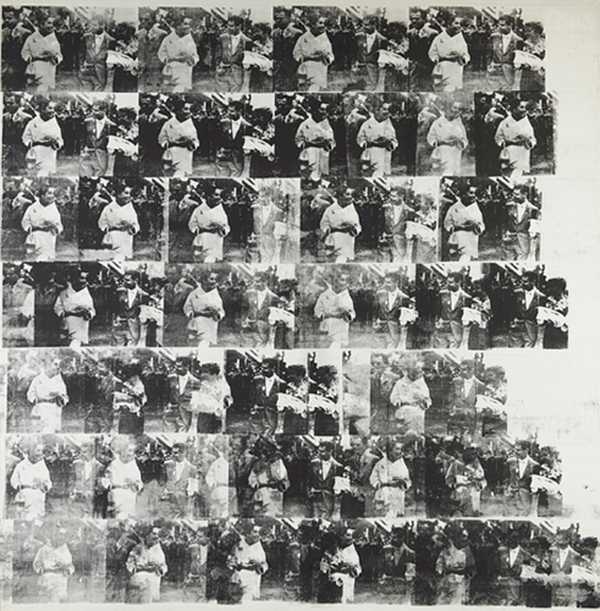

ANDY WARHOL The men in her life. 1962

Source:

Last week, the French Information Resource Artprice.com published its annual report on the state of the art market. According to the drafters, who retired in 2010 without any equivocation can be called revolutionary - first place for the auction sales unexpectedly left China . Celestial appeared for the first time in the top three most recently - in 2007, when she managed to shift from the third-place France (other positions uninterruptedly occupied Britain and the United States, dominating the art market in 1950).

last year of the decade was rich in events. Between 2004 and 2008, prices for works of art have grown considerably (especially "lucky" in such segments as Modernism and Contemporary), in late 2008, predictably, there was a correction, but in 2010 the market began to take new heights. It should be noted that after the previous crisis (in 1991) it took him four years to rebuild, but this time were just 18 months. In general, the two thousandth distinguished, firstly, the acceleration of normal processes in the art market, and secondly, the steady movement of the "center of gravity" of the East.

market structure has changed significantly due to the Internet (a significant number of transactions now take place online) and an increase in the number of art fairs (at the moment - more than 260 worldwide annually). In addition, a very prominent role in the 2000's have become investors and investment funds - Artprice.com called the growing popularity of investment in art, "a new socio-cultural phenomenon." There were even specialize in art exchange: a pioneer, not surprisingly, became China (Shenzhen Cultural Assets and Equity Exchange, 2009). From January 2011 Art Exchange Nakena Pierre (Pierre Naquin) selling shares in France in the works of Saul Levitt (Sol LeWitt) and Vetstsoli Francesco (Francesco Vezzoli).

Virage art Market

peaks for the art market is in 2007, when the sale of works of art at auction had generated 9.39 billion dollars. The sum is unprecedented. Just two years earlier, the overall result was two times lower. But in 2008 the art-market bubble has fallen victim to the global economic crisis - the millionaire collectors suddenly got sick to fly and Koons at inflated prices (hence the failure of autumn auctions of the year). The mood has been not - auction houses had to cut prices, give up the practice of security ... Result: In 2009, Christie's reported about reduction of annual income by 47%of its main rival, Sotheby's, a whopping 60%. The most stable segment were "old masters", in which the attachment to the less risky than a beloved speculators contemporary art - though the probability of market work, defined as "masterpieces", here too, as follows: almost all of the best works of old masters for a long time in museums. Nevertheless, the "quiet" in 2009 marked success of this particular segment: old masters increased compared with 2008 by 4,9%, while the Art of the XIX century, has lost 47.7%, Modernism - 37%, post-war art - 50.6%, and the contemporary - and does 63.8%. However, the sale of Andy Warhol (Andy Warhol) «200 dollar bills" for $ 39 million (excluding commission the auction house) at Sotheby's in November 2009 marked the return of the "top" of the market on their own circles. The result in 2010 was the sum of 9.36 billion dollars - not far from the 2007-th.

Contemporary Art returned

At the beginning of the previous decade, the creation of contemporary artists bought at public auction more carefully. If you look at different segments of the auction revenue in 2000, we can see that almost half of the "pie" (45.29%), then went to the modernists, the second most popular was the art of the XIX century (28.38%), followed by going old masters (15,16%) and post-war art (8,33%). Modern well got funny by today's standards of 2.83%. Today, this share rose to 10,2%. In concrete figures: in 2000 the sale of works by contemporary artists were generated 82.3 million dollars in 2010 - 954.8 million. Price index of the segment increased by 105.6%. Post-war art, meanwhile, increased in price by 157.9%. But the greatest interest is still causing Modernism: more than half the market in 2010 (4.75 billion dollars). Art of the XIX century, meanwhile, is losing popularity (in the past year, its market share was only 9,59 %).

started the year with world records in the most secure segment - 106.5 million for Picasso , 104.3 million for a sculpture by Giacometti . At the end of the first semester of Christie's and Sotheby's could boast of 62%-s and 103%-s growth, respectively (compared to the same period in 2009). On the market for modern art euphoria back in autumn, when specializing in this area auction house Phillips de Pury was able to gather for an evening 102.4 million dollars - the highest score in history ( 56,5 million occurred in Warhol's painting "The men in her life," featuring Elizabeth Taylor and her two husbands ). At the auction, "carte blanche", a work for which selected the well-known consultant Philip Segal (Philippe Ségalot), had set a record for the creation of Felix Gonzalez-Torres (Félix González-Torres), Cindy Sherman (Cindy Sherman), Daniel Byurana (Daniel Buren) Lee Lozano (Lee Lozano), Robert Morris (Robert Morris), Rudolf Shtingelya (Rudolf Stingel) and Thomas Schütte (Thomas Schütte).

In this regard, useful to recall the "three heroes "pre-crisis market of contemporary art - have in mind, of course, Damien Hirst (Damien Hirst), Takashi Murakami (Takashi Murakami) and Jeff Koons (Jeff Koons), at the peak of its popularity seeking an eight-auction results. The year 2009 was, to put it mildly, not the best time to sell the works of such "speculative" figure, which is why collectors and dealers prefer to keep their Hirst and Koons at all times. As a result, the market for Coons declined that year by one third, and the income of his British colleagues have lost 92%. In 2010, after the spot market bombing first-class works of modern art, old masters and post-war artists, auction houses are quietly began again to teach the audience to these "kings of the art market, hoping to revive pougasshy was interesting. October 14, the opening day of the most prestigious fairs Frieze, Sotheby's auctioned huge "painting with butterflies" Hurst estimate: 2,5-3,5 million pounds and was rescued for her 1.9 million. The same day the sculpture by Takashi Murakami, "Kaikai and Kiki" brought 1.7 million pounds, surpassing the estimate of three times - but not the fact that this result indicates the return of stable and high demand: maybe it was just a reaction to short-term hype Murakami exhibition at Versailles. What to Koons, it boasts "eight-digit" sales - 15 million for the blue "flower from a balloon, but the prospects of its market is still cloudy. Total estimated cost of Koons, appeared on the auction market in November 2010 amounted to $ 21 million (half of their value in 2007) managed to gain only about half that amount.

In any case, contemporary art is steadily going up: in the first half of 2010, the segment gained 5.4%at the end of the year an increase was recorded in 14,6%- the market has reached a level of 2006, which is very respectable.

material was prepared by Julia Maksimova, AI

Sources: , artinvestment.ru