Investment failures in art

Viewing ratings records with a person not fully prepared may give the false impression that investment in art almost by definition, are successful. Sorry, but it is not so

We love ratings record sales. They stimulate, inspire optimism and faith in the success of an art investment. They also, however, a person can not fully prepared to create a false impression that investment in art almost by definition, are successful. And when it comes to the world's strongest works of masters, profit-taking is inevitable, give a date. As many might think. But, unfortunately, it is not. Big name and high quality of the object did markedly reduce the risks and increase the chances of an investor to profit. But do not guarantee success. Investment "gaps", of course, there are. Moreover what. They are not made to focus: for emotional state buyers are not helpful. But sometimes it is instructive.

causes failure? This is very individual. Probably the most common problem is, if the investor is buying highly overpaid. At the auction, it happens, collectors infest and drive stakes into the clouds. But if a two-or three-fold excess of the estimate is a good thing for a few years to digest, then the price, which is 20 times higher than the estimate, the subject in the foreseeable future can not cope. And this happens regularly. Another reason for the failure of the investment can be in the situation on the market as a whole (for example - the crisis of 2008) and by specific authors in particular. Anything can happen: weaken the driving forces show specific artists become more rare, the interest to the author is reduced. As a result, the money invested in target date can not be compensated. Finally, the investor can simply not select an object for investment: buy a thing not of precious period illiquid - but who knows what.

so happened that at the beginning of the year just two analytical resource remembered about Art losers. - the essence of the once commercially successful artists who survived falling prices. A Skate's Art Market Research has just published the first part of the annual report on investment in art that are specific examples of unsuccessful investment in selectively segment Top-5000 the most expensive paintings . In general, it should be possible to find the numbers and poeffektnee, but here it is interesting that we are talking about the upper class, that is, the masterpieces. After a ticket to this Thor-5000 in 2012 went up to $ 2.3 million.

ratings Skate's begin. Our figures differ with them, because the loss on the transaction we recalculated their own way - in terms of the previous owner. That is, given the fact that people buy with the commission (recorded by us in the purchase price, take the data from the sites of auction houses), and the sale price received no commission.

So, the first line in this grief-Skate's ranking takes a picture of a failed investment in Marc Chagall «Music." The previous owner sold it in May 2012 for $ 2.1 million, while a year earlier he had bought it for nearly $ 3 million. Nearly a million a year as mysteriously disappeared. That's just what's so surprising? Losses could be more. It is known that for a successful resale pictures of this level takes a few years, "otvisetsya" to be in a collection or in storage until prices rise, and do not compensate for the overpaid money at auction. During the boom of the exotic (as it was with Russian art) for this year may be enough, but in the mature markets in the current world situation, a good thing to have at least 5-7 years. That is, there likely cause of loss - a discount of forced urgency. Probably not a good life. Otherwise, a special trick not see: walk and walk. Good size (130 x 80), a good story. Yes, this is 1967, closer to the later period, which is the step of the less valuable. But in general, nothing, except for a small period of possession, did not convincingly explain the situation.

If we assume no loss in percentage, and the money, the palm in 2012 belongs to the work of Flemish master Baroque Anthony van Dyck (1599-1641). In January 2012 his "rearing stallion" was sold for $ 2.2 million - 3.85 million less than it was bought 4 years ago. Also a one-time failure. Conjuncture by Van Dyck is generally very good. And 2-5 million for him is not the limit. Record and does about $ 7 million. In addition, it is estimated artprice, $ 100 invested in his work at the beginning of 2011, the end of 2012 turned into $ 148. Complain. For the first time, four years ago, bought the painting is three times more expensive than the estimate. Probably at that time buyer strong inspirations. And when re-selling item has not failed, but just left within the estimate.

the other players in the list of their owners upset by 8-12%per year. It's unpleasant, but not fatal. It can be assumed and causes. By Vuillard situation has changed. He quickly gained in price, its price before the crisis, the index reached a peak, and then followed by a sharp decline. Since 2007, the price index for Vuillard artprice lost 65%. Why summed Monet? Perhaps the owner is not matched with the quality of art - a thing, in my opinion, not outstanding. Why discount left "Khork» Arshile Gorky ? Maybe too conjuncture. Bought it at the price peak. During the crisis, prices have tumbled. And now, the price index of the artist, which we incorporate into the orbit of Russian art, is at levels of 2003-2004. So everything is logical.

list of "losers" from Artinfo does not rely on specific failures. The criterion was the most general sense of the market, reduction of interest and, of course, lower prices. Like, people have been on a horse - and taken all gone. And are not taken up the year, and a large enough historical period.

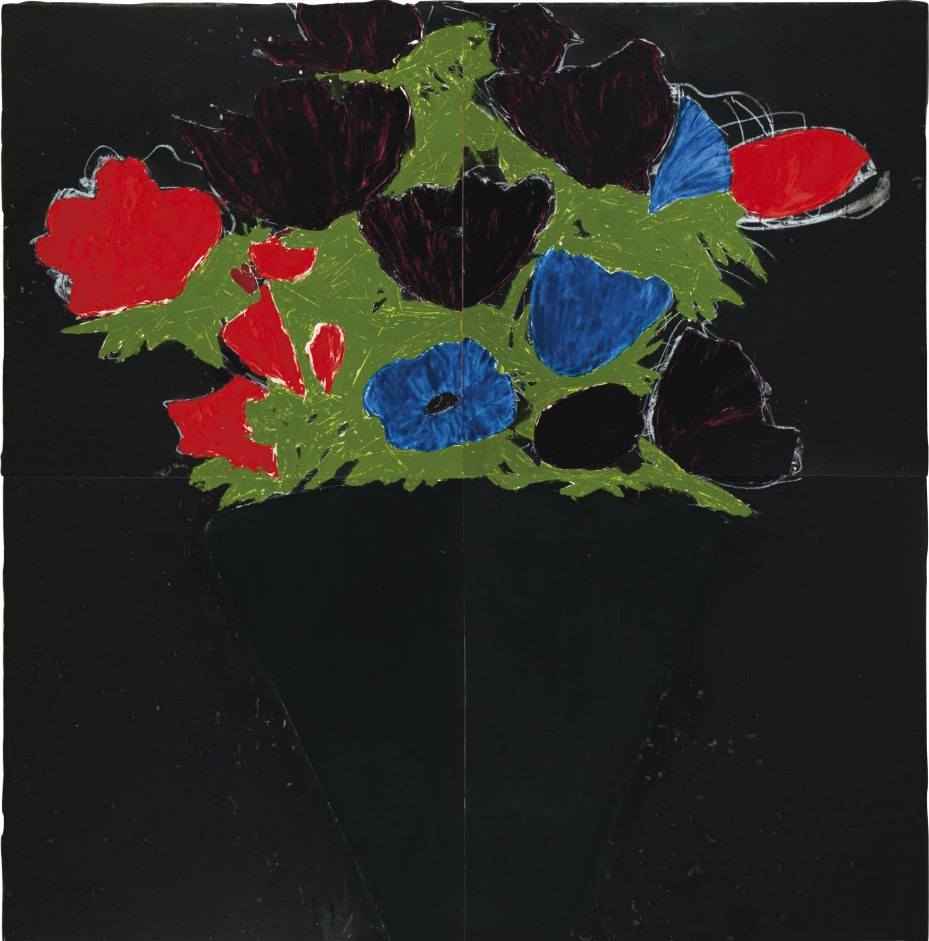

For breakfast in the rating "yesterdays heroes" in Artinfo some reason included Hirst. Difficult to hide the sarcasm in relation to this writer feels the way, in both rankings. When the three years from 2008 to 2010 is the theoretical $ 330 invested in the work of Hirst, turn into $ 100 - it's hard to forgive. But I must say that the last couple of years, prices for Hirst went up again. Yes, a little bit, 10%for two years, but is also a process. So why is against this background it is in 2012 include the artist among the losers? Skate's alluding to the fact that no new work Hurst this year failed to overcome the bar to the $ 2.3 million needed to get into the Top-5000. Everyone would be such a problem. Of living artists, "losers" company British avant-garde artist Donald Sultan were (Donald Sultan, 1951), Anselm Reilly (Anselm Reyle, 1970), Ross Blekner (Ross Bleckner, 1949) and Jennifer Bartlett (Jennifer Bartlett, 1941).

assumptions about the causes are quite interesting. For example, career Jennifer Bartlett almost waned after the break with the influential galeristka. In the absence of strong driving forces and auction prices have gone down. Someone was too frisky start, and the high price could destroy the emerging among collectors - on different occasions.

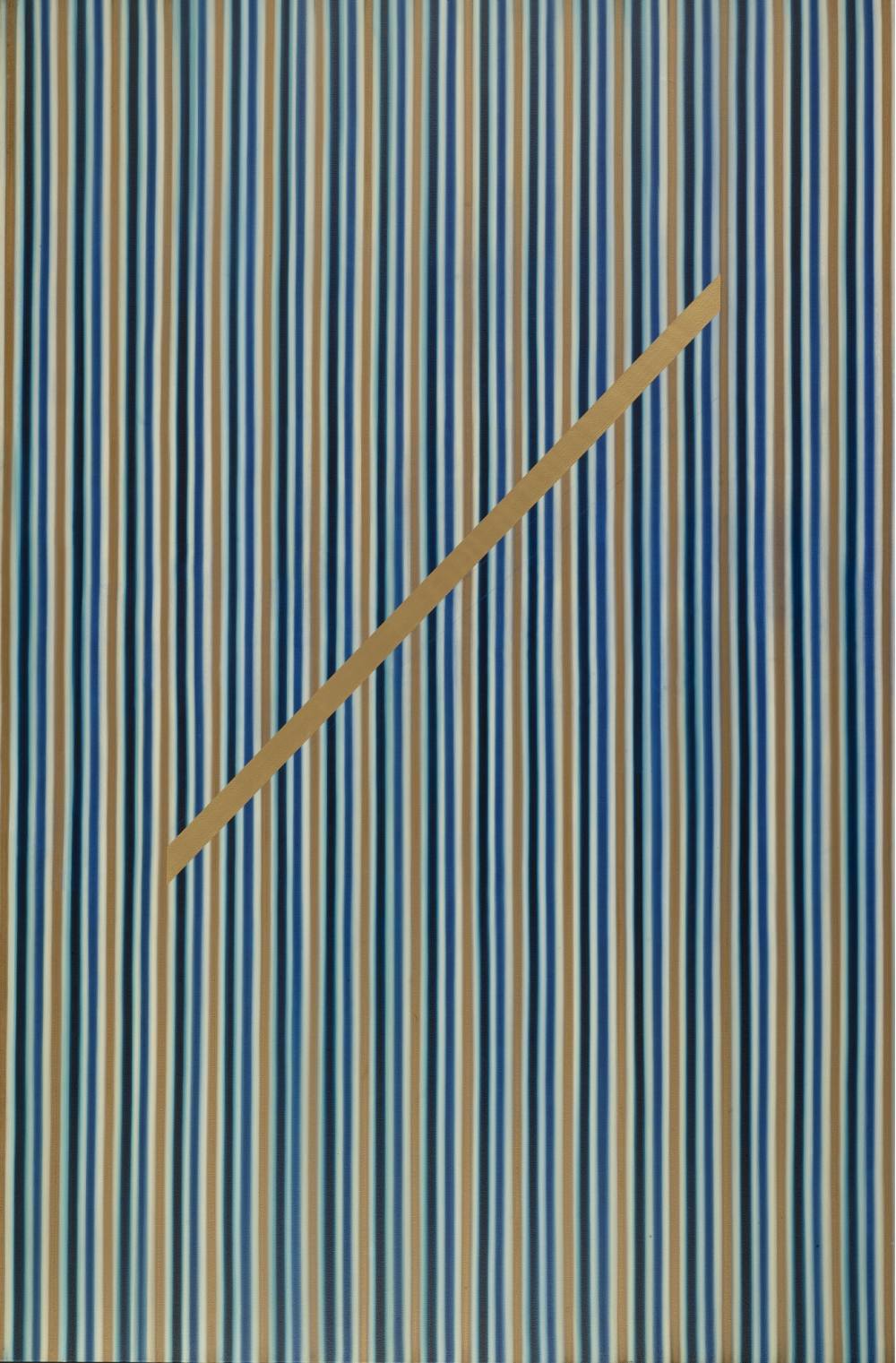

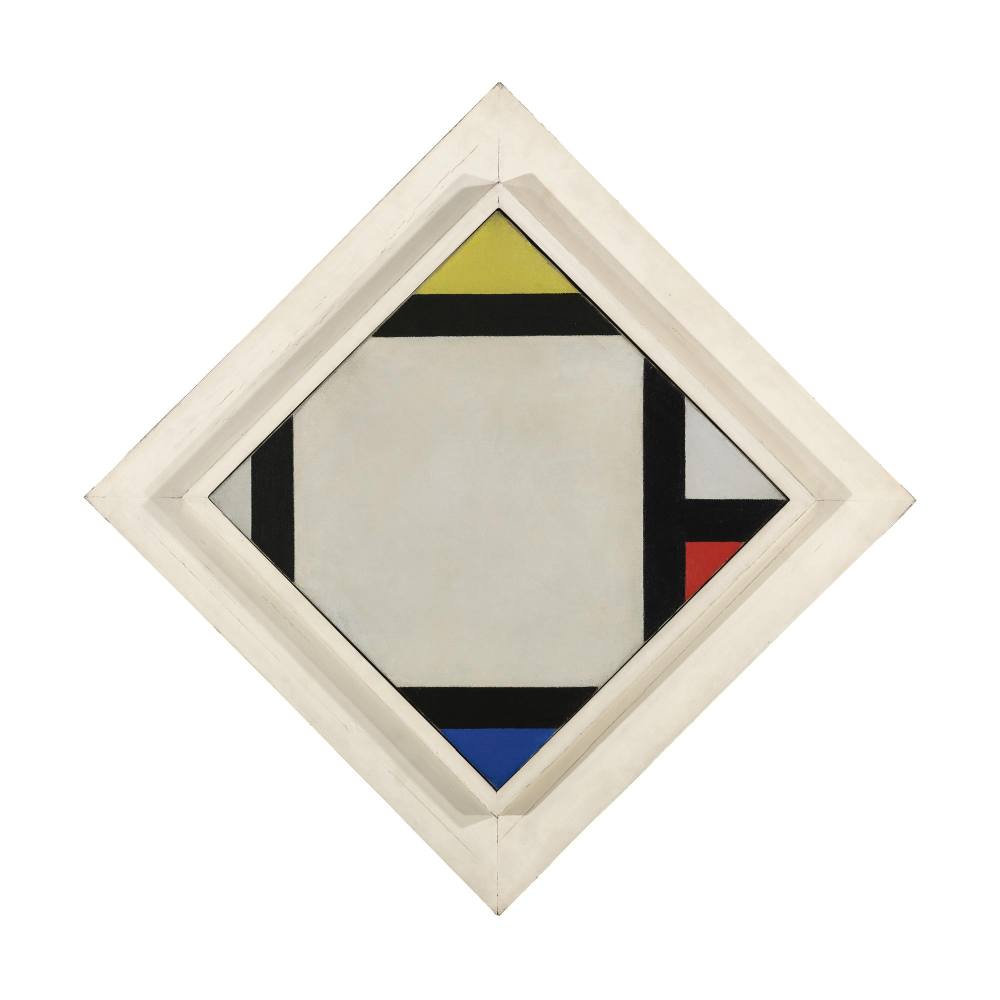

is referred to Artinfo and long-gone artists. There's the usual story: if life were on par with the great, and then got some fame and recognition, while others have remained "artists circle of someone." For example, Theo van Doesburg (Theo Van Doesburg, 1883-1931) - founder of the "Style» (De Stijl), Mondrian's friend and associate, also made the original discovery. But the market price dug a chasm between them: Mondrian record - $ 18 million. Or March Simkins (Martha Simkins, 1869-1969) - an American, a student of John Singer Sargent in 1920 participated in the Paris salon. In the thirties, came to America in his Dallas. Today the price of its work 3000-6000 dollars, and buy them primarily in Texas. And there are a lot of stories: successful career at the time artists were collapsing, interest has declined, prices fell, and eventually forgotten names - with little or.

Theo van Doesburg Contra-Composition VII. 1924 canvas. 45.5 x 45,5 Estimate: 1 800 000-2 500 000 Price: 4,184,000 USD (c BP) Sotheby's. 08.05.2010 Source: MARCH Simkins Still Life Oil on canvas. 66.04 x 55,88 Estimate: 4 000-8 000 Price: U.S. $ 3400 (without BP) David Dike Fine Art, Dallas. 22.10.2005 Source: artsalesindex.artinfo.com , liveauctioneers.com |

In the top segment of the market for Russian art cases markedly falling prices for memory, honestly, do not come. Fakes do not count. A such that the multi-million selling discount masterpieces in the auction market can not remember. And as for the gallery-"situation" telling is not accepted. But the old-timers remember the market as people burnt to "untwist" artists. For example, in the late 1980s and aggressively promoted artists Alexander Parkhomenko and Eugene licorice. Almost auctions were held, and the prices were serious. In 1990, some of their work, the stories were worth almost 10 000 (in current money under 20,000 dollars, and then, by the way, "Lada" is officially on sale for 6500 rubles). Now about the artists and prices are only memories. Statistics auction results Solodky sales data are not available, but for Parkhomenko have found a single record of unsold lot offered for French auction in 2007 for 400-600 euros.

moral of the story that any investments have an element of risk. Even the most miscalculated. If the act forcibly, relying only on his natural taste and way of ignoring the market, it can be such mangled wood that will not find it.

Vladimir Bogdanov, AI

Sources : skatepress. com , artprice.com , artinvestment.ru , artinfo.com

Permanent link to:

https://artinvestment.ru/en/invest/analytics/20130204_top10_loosers.html

https://artinvestment.ru/invest/analytics/20130204_top10_loosers.html

© artinvestment.ru, 2025

Attention! All materials of the site and database of auction results ARTinvestment.RU, including illustrated reference information about the works sold at auctions, are intended for use exclusively for informational, scientific, educational and cultural purposes in accordance with Art. 1274 of the Civil Code. Use for commercial purposes or in violation of the rules established by the Civil Code of the Russian Federation is not allowed. ARTinvestment.RU is not responsible for the content of materials submitted by third parties. In case of violation of the rights of third parties, the site administration reserves the right to remove them from the site and from the database on the basis of an application from an authorized body.